It’s okay to admit it: most private-practice lawyers are well paid. But it can be hard to know what to do with all that money. How to invest, what to splurge on and how much to give to charity — it’s all a bit of a mystery. So we got six Toronto partners into one room to find out how they get a handle on their money.

Our money experts

Andrew Alleyne

Fasken Martineau DuMoulin

Technology

Linda Misetich Dann

Bennett Jones

Securities

Georges Dubé

McMillan

Corporate

Hilary Goldstein

Buchli Goldstein

Entertainment

John McLeish

McLeish Orlando

Personal injury

Heather Zordel

Gardiner Roberts

Securities

Why you should blow your first paycheque

Meet your moderator:

Daniel Fish

Precedent Magazine

Daniel: How did you manage the transition from cash-strapped law student to well-paid associate?

Andrew: It’s funny to think back. As a student, I was so frugal. But once the paycheques rolled in, I spent more and more, until I was living right at my means. Then one day I thought, What the hell is going on here? Why am I spending all my money?

Daniel: The more money you make, then, the less prudent you are?

Heather: Of course! But that’s not a bad thing, at least in the early days of a legal career. Coming out of law school, you’ve been living poorly for a long time. So you have some catching up to do. Buy nice clothes. Take vacations. I don’t think anyone should worry about saving when they’re under 30.

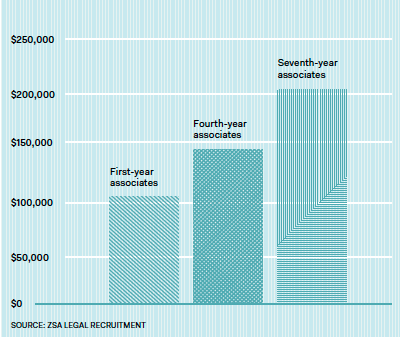

Live and earn

Most associates have a fair bit of money to spend, and it creeps up each year. Here’s a look at the average annual earnings of associates at large firms in Toronto.

Daniel: Any other advice on how to spend those early paycheques?

Heather: Don’t use it to buy a house too early — especially if you don’t have a family or actually need one. Every associate wants to do this right away, but they forget something crucial: it costs a lot of money to nurture their legal careers. Instead of spending their income on mortgage payments, they should be taking clients out to lunch, going golfing, flying to conferences or joining clubs. That could be the Toronto Board of Trade or the National Club. If they want to make big money later, that’s what they have to be doing.

Andrew: And remember, housing is not an investment. It’s a building you live in. Even if the price rises, and you sell it, you still have to buy another one that costs just as much money.

Ed. note: John flashes an enthusiastic thumbs-up.

Daniel: That means junior associates should rent?

Andrew: That’s what I did for a decade. And I was happy with that.

Hilary: Well, I bought a house early because I wanted to get into the market. And I bought at a time when prices seemed to dip [Ed. note: in the early 2000s], so I thought it was a good investment.

Investing for dummies

Hilary Goldstein

Daniel: Once an associate hits 30, buys that first house and wants to start saving, what’s the best way to do so?

Linda: Here’s what I do. Each month, I pay my fixed costs — mortgage payment, bills — and put some money into savings. Then I have the flexibility to use the rest on whatever else I’d like, from a vacation to a new phone to a new suit.

Daniel: Does anyone here keep a budget?

Ed. note: no one raises a hand.

Georges: I don’t itemize my life on a spreadsheet, but, in my head, I will casually allocate some money for food, clothes or travel.

Daniel: How do you invest?

Georges: First, I don’t do it myself. I don’t know how. Over my career, I’ve kept my eyes peeled for colleagues and friends who are great with money, and asked them which professionals they use. But to manage my own money would be like self-dentistry.

John: When I was young, I made that mistake. I thought I could invest in the stock market on my own. I’d hear from someone who’d heard from someone that I ought to buy shares in this or that company. I should have shorted everything I bought! So now I put everything in an investment fund that someone else manages.

Daniel: And it’s always stocks or mutual funds? No savings accounts or GICs?

Andrew: Those don’t make much sense. My wife, for example, is finally putting some of her money into the market, after a lifetime of using GICs. For long-term investments, it’s a no-brainer.

Enjoying the journey

Daniel: What sorts of things have you splurged on over the years?

Hilary: Jewellery, which I often buy at milestones. When I became a partner at my old firm, Heenan Blaikie, I bought myself a really nice watch.

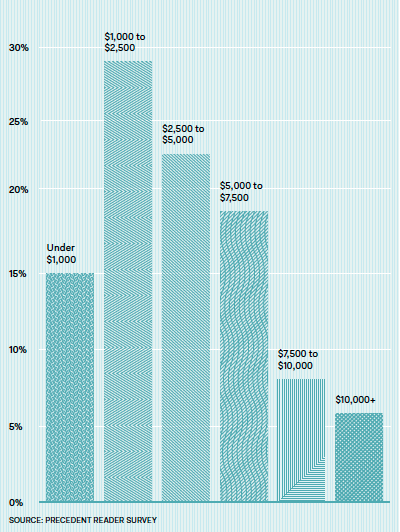

Big spenders To look as good as they do, lawyers in Toronto are happy to spend money on clothes — on average, about $4,100 a year. (That applies to both men and women.) But some spend far more. Here’s a breakdown of how much lawyers put toward their wardrobe each year.

Linda: I do the same thing. I think saving is essential, but it’s important to enjoy life, too. Soon after I made partner, I found myself on Fifth Avenue in New York City. So, to treat myself, I bought a string of pearls. That somehow seemed like the adult thing to do. I still wear them sometimes, and it makes me remember that moment.

John: I have built myself the nicest house on the planet! It’s a Gluckstein-designed house. [Ed. note: Brian Gluckstein is among the world’s most famous interior designers]. And my wife and I take lots of vacations. I’m going to Aspen in a few weeks, then on a 10-day cruise in the Mediterranean a few weeks after that.

How to get rich

Daniel: Who are the richest private-practice lawyers in Toronto?

Georges: I would think the top criminal lawyers, who have the highest profiles and can bill the most.

Daniel: So Marie Henein tops the list?

John: I don’t think so. Here’s why: Marie Henein’s clients want her on their cases. And that limits how much money she can make. The best-paid lawyers spend their time bringing in new clients — then they delegate most of the actual work to associates and get a cut of each file. Marie Henein is brilliant, but she couldn’t have passed the Jian Ghomeshi file off to another lawyer.

Linda: That’s exactly right. If you can bring in enough business to allow six lawyers to bill 1,500 hours a year, you’ll make far more than if you had billed 2,000 hours yourself.

Daniel: In the next decade, are any practice areas set to take off, making it easier to drum up business?

Linda Misetich Dann and Heather Zordel

Heather: It’s hard to know for certain, but I’d say wills and estates looks promising. All the baby boomers are reaching old age, so they’ll need lots of legal work.

Andrew: Hold on a second. We have to be careful about this line of thinking. Associates should not be picking a practice area based on the financial rewards it might offer.

Hilary: And yet, so many people do.

Andrew: I know. It’s crazy. A career in law is hard enough. If you work in an area that doesn’t interest you, you will not last. You’ll leave the law. And then you won’t make any money.

Hilary: This is an important point. I was careful to pick a practice area I really enjoy. If you don’t do that, chances are you’re not going to be doing it in five years.

Should you switch firms?

Daniel: For associates, when is switching firms a smart move?

Andrew: When it makes sense long term. Take my career: I’ve worked at Faskens from day one, for the past 13 years. As an associate, I got an offer from another Bay Street firm that would have come with a raise. But I said no, because I knew they’d never in their life make me a partner.

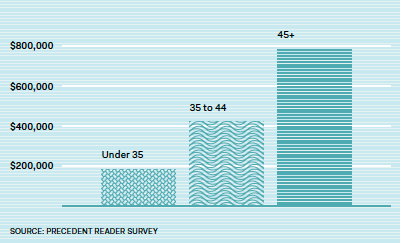

Bank on it Want to know how much money your colleagues have? Here are the average savings of lawyers in Toronto, broken down by age.

Daniel: How did you know?

Andrew: Because I’d talked to people I trusted and determined that I wouldn’t be able to get onto that firm’s partnership track.

Linda: Never switch firms to make a few thousand dollars more in the short term. That makes no sense. Make sure you see a path to making partner.

How not to raise a spoiled brat

Daniel: How do you teach your children about money?

Hilary: I have two kids, ages 10 and 13. I’ve talked to them about money since they were old enough to understand. And my message is simple. When they make any money — by that I mean when they receive their allowance or get money on their birthday — it goes into three buckets: money to spend, money to save for big purchases and money for charity. My daughter just had her bat mitzvah, and she gave a portion to the Red Cross’s Fort McMurray relief fund.

Daniel: What do you buy for your kids without worrying about spoiling them?

John McLeish

John: I don’t have children, but I do have a nephew who I’ve tried to take care of. And I will happily pay for two things. Number one is education. I covered his tuition for private school at Ridley College and for his MBA. Secondly, from time to time, I’ll pay to take him — plus his wife and baby — on vacation with my wife and me.

Andrew: I don’t have any kids, but there’s no way vacations count as spoiling — they’re a life experience.

Hilary: I love going on vacations with my kids. A couple years ago, we spent a week at a house we rented in Jamaica, and though it might have been a luxury, I never felt guilty. It also lets me spend more time with them. And if I’m not working, it’s all the better.

Heather: When I go on vacation with my daughter, though, I always work a little bit. When she sees me pop off to make calls and send emails, it reminds her: that’s what pays for all of this.

Georges: I’d add that it’s important to teach kids that the tap will eventually shut off. My parents grew up in the Depression, so they were frugal. But the one big thing they paid for was my private-school education. It came with a catch, though: after they educated me, I’d be on my own. Years later, when I wanted to buy a house, I didn’t quite have enough for a down payment. So I called up my old man and said, ‘Hey dad, I’m a little short.’ He goes, ‘Good luck, you’ll do just fine’ and hangs up the phone.

John: Good for him! When my nephew decided to buy a house, I also decided not to give him any money for it.

Daniel: Why not?

John: I honestly thought it would be spoiling him. I’ll pay for education, but I’m not gonna buy him a house or a car, or fix his roof.

Giving back

Daniel: How much should successful lawyers give to charity?

Georges: I think 10 percent of what they make.

Linda: I know we all work hard, but we’re very fortunate. Donating to charity may be tough to do early on, but it’s really important.

Daniel: Who do you donate to?

Andrew Alleyne

Heather: To start, if you have a client that regularly supports a certain charity, then that means you’re donating to the charity’s fundraisers and, when it has a dinner, you’re buying a table.

Georges: It’s a personal choice, but for the most part I give to educational institutions.

Daniel: Why?

Georges: Both Upper Canada College and McGill made me what I am today. I feel like I owe them. And at UCC, every student is subsidized through alumni contributions, so I’m helping other people have the same opportunity I had.

John: I love that. I know I wouldn’t be sitting at this table had I not gone to Ridley, Western and Dalhousie. I give regularly to all three. I’ve done something significant in my will for them, too.

Georges: Giving back is far more important than any of the products we could buy. Think about it: you’ll never see a U-Haul at a funeral. We can’t take all of our stuff with us.

This story is from our Fall 2016 issue.

Still life photography by Vicky Lam. Roundtable photography by Ryan Walker. Shot on location at McMillan LLP